En Belgique, les voitures de société dominent le marché des voitures neuves. Près de 6 voitures sur 10 sont immatriculées au nom d’une entreprise — et une grande partie de ces véhicules est également utilisée à titre privé, souvent sans frais pour le salarié.

Ce système peut sembler avantageux pour l’entreprise comme pour l’employé, mais il représente un manque à gagner fiscal majeur pour l’État. Un nouveau working paper du Bureau fédéral du Plan explore cette question et met en lumière les impacts budgétaires et comportementaux de la fiscalité automobile actuelle.

Pour les professionnels en fleet management, ressources humaines, finances ou mobilité durable, cette étude livre des chiffres clés à connaître. Voici un résumé clair, orienté action.

💸 Voitures de société : plus qu’un avantage, une dépense fiscale considérable

- Le régime fiscal actuel génère d’importantes “dépenses fiscales” — des recettes non perçues par l’État à cause d’avantages fiscaux spécifiques.

- Ces avantages comprennent une imposition réduite de l’ATN, l’exonération des cotisations sociales personnelles, une TVA récupérable en partie, et une déductibilité partielle des frais pour l’entreprise.

- Selon l’étude, à l’horizon 2028, ces dépenses fiscales atteindraient 5,2 milliards d’euros par an si le système reste inchangé.

En clair : les voitures de société sont nettement moins taxées que l’équivalent en salaire, ce qui pose question dans un contexte de transition écologique et de pression budgétaire.

📊 Un scénario neutre : et si on taxait l’avantage voiture comme du salaire ?

Les auteurs ont comparé deux situations :

- Le système actuel, avec tous les avantages fiscaux.

- Un scénario benchmark, dans lequel la voiture est imposée comme si l’employé devait en assumer tous les coûts lui-même.

Le modèle CASMO, qui simule la composition du parc belge, a permis d’estimer les effets financiers et comportementaux.

Résultats clés en 2028 dans le scénario benchmark :

- + 4,3 milliards € en recettes d’impôts et cotisations sociales

- + 0,6 milliard € de TVA non récupérée

- – 0,1 milliard € de recettes ISoc en moins

👉 Soit un gain net de 5,2 milliards €, sans même réduire le nombre de voitures de société en circulation.

🚘 Quelles conséquences pour les flottes d’entreprise ?

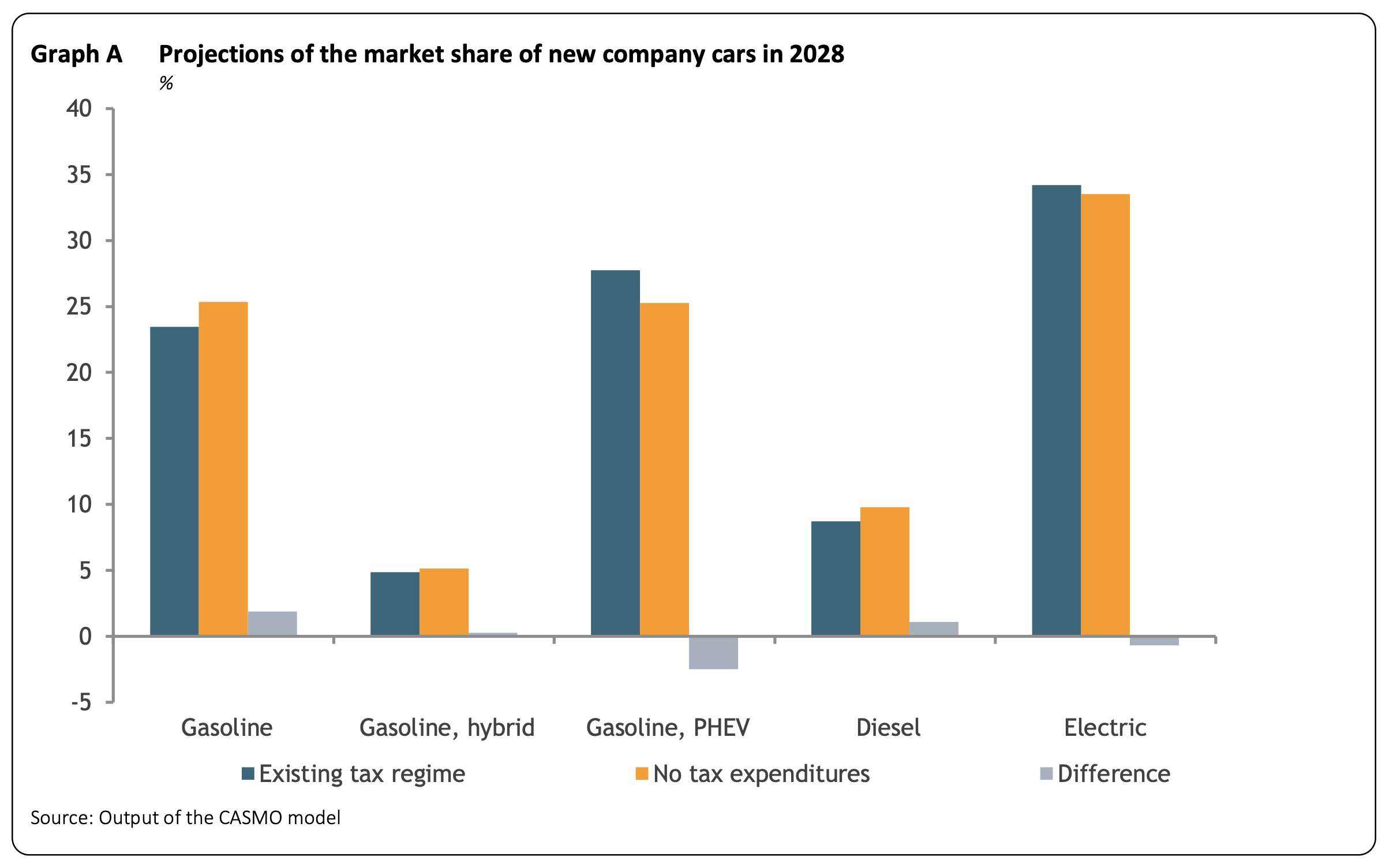

L’étude simule l’impact fiscal sur la composition des motorisations :

- Hybrides rechargeables (PHEV) : baisse de part de marché de 27,8 % à 25,6 %

- Véhicules électriques (EV) : baisse légère de 34,2 % à 33,5 %

- Essence et diesel : hausse marginale

Pourquoi ? Parce que le système actuel favorise fiscalement les faibles émissions de CO₂. Sans cela, la compétitivité des EV/PHEV diminue — et la recette fiscale par véhicule augmente.

📌 Cela souligne que l’adoption des voitures électriques reste fortement dépendante des incitants fiscaux.

🧭 Ce que les entreprises doivent retenir

Si vous êtes en charge des flottes, de la politique RH, ou du budget mobilité, voici ce que cette étude vous dit :

✅ Points d’attention :

- Le différentiel de coût fiscal entre salaire et voiture est réel — et de plus en plus visible.

- Les incitants à l’électrification sont puissants aujourd’hui, mais pas éternels.

- Le budget mobilité est encore sous-utilisé, alors qu’il offre un cadre plus souple et équitable.

- L’administration fiscale pourrait resserrer le contrôle sur l’usage privé réel et les cartes carburant.

- Il est temps de penser à des alternatives durables : vélo, transports publics, multimodalité, etc.

🌱 Chez Next Mobility, nous vous aidons à gérer votre transition

Cette étude confirme ce que beaucoup ressentent : l’ère de la voiture de société comme avantage par défaut touche à sa fin.

C’est le moment idéal pour :

- Repenser votre stratégie flotte

- Recalculer le TCO selon les motorisations

- Mettre en place un budget mobilité

- Aligner les équipes RH, finances et RSE autour d’une politique de mobilité responsable

📚 Source :

Bureau fédéral du Plan (2025), Working Paper 202504 – Dépenses fiscales liées aux voitures de société

Vous voulez comprendre ce que cela implique pour votre entreprise ? Parlons-en : www.nextmobility.be